Read our full report on what the Buderus closure means for knifemakers, Damascus production, and company inventory.

Once when he was ill, Mark Twain famously quipped that “rumors of my death have been greatly exaggerated.” October 2025 brought troubling rumors to the knife industry regarding the potential closing of a major steel mill owned by Buderus Edelstahl.

Based in Wetzlar, Germany, Buderus is a major producer of 10xx series steels, including 1075, 1084, 1095 and 15N20, that are purchased through various suppliers. The company was founded in March 1731 and began steel production in April 1920. It has changed ownership several times, including being purchased from Bohler-Uddeholm by Voestalpine. Voestalpine sold the company to the German investment company Mutares in 2025.

BLADE® reached out to knife industry steel authorities for comment.

Dr. Larrin Thomas reported that he had spoken directly to two different Buderus employees.

“We have been hearing conflicting reports about whether the [Buderus] hot and cold mills are being shut down,” he wrote in an e-mail. “Regardless, things are a bit too murky right now to say much definitively.”

If the rumors inside the Buderus workplace match the ones inside most large workplaces, there’s a good chance that conflicting perspectives and speculation are flying around everywhere. It could be difficult to get to the actual facts, even directly from mill employees. However, Larrin remained hopeful.

An email obtained from steel supplier New Jersey Steel Baron (NJSB) was less hopeful. This past October, NJSB officials notified their intermediaries that the Buderus mill was closing at the end of the month. The email stated, “We are writing to inform you that as of October 31, 2025, Buderus Edelstahl, one of our primary vendors, will be ceasing its rolling operations. This marks the end of a fifteen-year partnership for NJ Steel Baron, and we anticipate it will significantly impact the bladesmithing, blacksmithing, and cutlery industries. We have already begun to pivot our production to new vendors and source new alloys to ensure our inventory remains robust.”

A story on n-tv.de, an online news platform based in Germany, carried the headline “Buderus Edelstahl steel is broken up—hundreds of jobs affected.” The story reported that, “The company’s steel mill … is to be closed by the end of October, Mutares announced.”

NJSB’s Peter Bruno took the news hard, saying “I’m going to have to spend some time in the woods thinking about it.”

In the NJSB press release he stated, “This has been more than a vendor relationship; it’s been a cornerstone of our steel program. Buderus has consistently delivered high-performance German steel that’s fueled makers, machinists, manufacturers, and craftsmen throughout the world. Losing this supply chain is a hard hit, not just for us, but for the entire industry.”

Beyond the pure shock of losing its main supplier, NJSB is developing a plan. It has a good amount of steel on hand and is buying all the remaining Buderus stock it can. NJSB also has reached out to its customers and is selling steel by the pallet to ensure customers have at least short-term reliable access to the steel they need for ongoing orders.

“While we’re actively working to develop new sources and mill partnerships, the shift won’t be immediate, and some grades may remain out of reach for a while. Some alloys may not return anytime soon, if at all,” Bruno noted. “Once supplies run out, that may be the end of the line in some cases.”

Company Responses

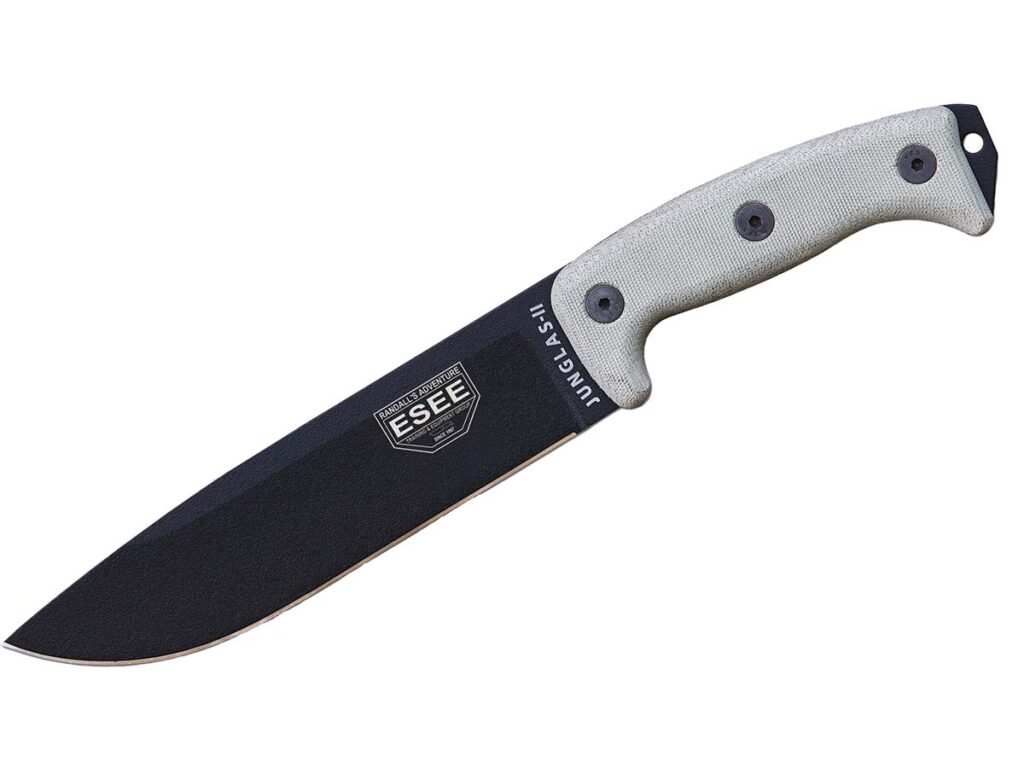

The 10xx series steels are used by several knife manufacturers and importers for their hunting, outdoor, tactical and other utility-type knives. Some of those companies include Condor Tool & Knife, ESEE, KA-BAR, Utica, the previously mentioned TOPS and White River Knife & Tool. Some of the foregoing deal with Buderus and some do not. The 10xx series steels are also widely used by custom knifemakers for damascus and straight carbon knives.

Mike Olen, director of sales at Condor Tool & Knife, said Condor was not sourcing any steel through Buderus.

“For the 1075 and 1095 steels, we get them from a variety of vendors, mostly Europe and Asia based,” he noted. “I’m not sure exactly, but I know a lot of our steels have been coming from German and South Korean companies lately. We do the heat treatment in house, so it opens up more options for us when sourcing the raw materials.”

“KA-BAR has had a long relationship with Buderus,” wrote KA-BAR’s director of sales and marketing, Joe Bradley, though he added any potential closure of the Buderus steelworks would not affect KA-BAR immediately.

Powell said TOPS gets its steel from a leading distributor, though it was unclear at press time whether that distributor used Buderus as a source or not. At press time, he said TOPS was fine in terms of its supply of 10xx series steels, though the company likely will start stockpiling the steels in case of any shortages.

Suppy Alternative

Jantz Supply is a leading source of 10xx series steels for custom knifemakers and others. Jantz’s Shanna Kemp indicated her company maintains various sources of the steels and as a result does not expect supply delays.

“We don’t expect any disruption from the Buderus mill closure,” Shanna wrote. “Jantz has strong relationships with multiple mills, so makers can count on us for steady access to the high-carbon steels they rely on. Our commitment to providing reliable, high-quality materials for knifemakers will not change.

“We have long-standing relationships with multiple steel mills and distributors worldwide. The majority of our 10xx series high-carbon steels come from reputable suppliers in the United States and Germany. This diversified supply chain ensures consistent quality and availability for our customers.”

In fact, Shanna said Buderus is but one of a number of producers of 10xx series steels.

“I don’t know the exact quantity of 10xx series steels the Buderus mill produced. However, they were one of several manufacturers worldwide,” she noted. “The 10xx series is a widely produced grade family, and multiple mills continue to make these steels. While the Buderus mill was a respected supplier, their closure does not significantly impact global availability.

“Several mills and processors around the world continue to produce 10xx series steels. While the Buderus mill was a respected manufacturer, these grades are not unique to any single producer. The market has ample capacity to absorb the change, and we don’t anticipate any long-term supply issues.”

Past Is Prologue

If all this sounds a bit familiar, Crucible Steel went through a similar process of bankruptcy and acquisition at the beginning of this year. Owners of the familiar CPM (Crucible Particle Metallurgy) trademarks for MagnaCut and others, Crucible was a major force in the knife industry. Eventually it restructured and cut its research and development division. Ultimately even the restructured company failed and was sold in parts to Erasteel of Europe and an American company, Lauter. Erasteel continues to produce steel of the same compositions with the same names, as it purchased Crucible’s intellectual property. Lauter owns the former Crucible factory and has begun hiring for its specialty business of manufacturing screws and fasteners.

The Crucible situation had some impact on the knife steel business. Dr. Larrin Thomas sat down with Bob Shabala of Niagara Specialty Metals in May for a conversation about the transition. Niagara is the primary rolling mill that served the knife industry in taking Crucible steels from 3,000-pound billets down to workable sizes. Bob explained that Crucible was one of Niagara’s biggest customers, but that it also was up front with its struggles. Consequently, Niagara was well stocked in CPM steels by the time Crucible folded.

Niagara also works with Erasteel and Carpenter, both of whom have the technology to produce steels of the same composition. Steel from Erasteel will retain the CPM trademarked names. Other versions of the same alloys rolled by Niagara will have new names for the steels the industry has used for years. Niagara officials predicted some disruptions because of panic buying as Crucible closed, but they also think business will return to “full speed ahead” for production of the knife steels in the former CPM formulations. Larrin indicated that Magna-Cut will survive and continue to be produced without disruption.

What’s Next

The steel industry has been challenged for many years, with more bankruptcies than start-up companies. To complicate things further, the steel the knife industry uses and needs is only a very small and specialized portion of a global steel industry that includes structural steel, automotive and more. With insatiable demand worldwide, the knife industry’s little corner of the market doesn’t get much attention. On top of that, steel production takes an enormous amount of energy, and with all the green and climate change talk of recent years, no one seems to be lining up to build anything but AI data centers at the moment.

Like the transition away from Crucible, the probable transition away from Buderus will no doubt cause some industry disruptions. For now, knifemakers can hope that rumors of the death of the Buderus mill remain greatly exaggerated—or at least, as with Crucible, its reincarnation is on the horizon. Will some other company buy the Buderus mill? Will, like Niagara, some other supplier step in the gap left by the closure? Will someone in the market feel the void and fill it? Time will tell, but for now, the best advice seems to be for knife companies and makers to buy the 10xx series steels while they can.

Editor’s Note: Blade Magazine Staff contributed to this report.

More On Steel:

Read the full article here